Among the most popular, basic PIT forms are:

PIT-28 form

The PIT-28 form is intended for taxpayers engaged in business activity, taxed on a lump sum from registered income. It also applies to those earning income from rental, sublease, lease or subtenancy, as well as those earning income from the sale of agricultural products processed in a manner other than industrially.

Pit 28S is filed in connection with tax settlements after the death of an entrepreneur benefiting from lump sum taxation.

PIT-36 form

You will choose the PIT-36 form if in a given year:

- you were engaged in a non-agricultural business activity, taxed on a general basis (including using a tax credit or settling in one of the five consecutive years after its use),

- you were operating in the framework of special activities of agricultural production, taxed on a general basis.

However, this applies only to the following revenues:

- from rental, sublease, lease or similar contracts in the course of business (note: only in the course of business - this change took effect starting with the 2023 settlement),

- from domestic sources, on which the payer has not provided information about their amount and for which you must settle taxes yourself,

- from foreign sources, obtained without the intermediation of Polish contributors.

PIT-37 form

It is primarily intended for employees who are not self-employed and earn income from an employment contract, contract of mandate or contract for work.

PIT-38 form

The PIT-38 form is intended for those who, during the tax year, received income from the paid disposal of securities, borrowed securities, derivative financial instruments, the exercise of rights arising therefrom, and shares in incorporated companies. PIT-38 is also to be filled out by taxpayers earning income from taking up shares in incorporated companies or contributions to cooperatives in exchange for contributions other than in cash, in a form other than a business.

PIT-36 and 37 returns are the most popular tax return forms.

PIT-37

PIT-37 is intended for taxpayers who earn and settle their income through payers. Thus, it is valid for employees, contractors, pensioners and other persons for whom advance tax payments are calculated and collected by the payer.

When settling the PIT-37 form, it is also possible to settle jointly with a spouse and as a single parent (meeting the relevant conditions).

PIT-36

PIT-36 is designed for those who earn income (under the 12-32% tax scale) without the intermediation of a payer. These will be taxpayers engaged in non-agricultural economic activity and unregistered/unrecorded activity. However, it will not be settled on its basis for those who carry out activities accounted for by a registered lump sum (the exception will be having two activities - one accounted for according to the PIT-36 scale, the other by a lump sum; the taxpayer then submits two separate returns).

Here you can find all the official PIT forms

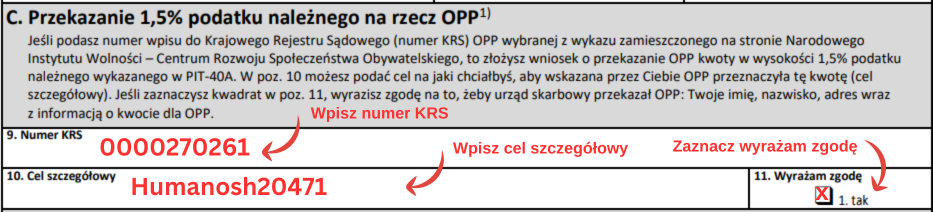

1.5% for Public Benefit Organizations

When settling your PIT, take advantage of the opportunity to donate 1.5% of tax to Public Benefit Organizations. By donating this percentage to the Young-Young Student Foundation, you are thereby supporting the Humanosh Foundation and making a real impact on its future.

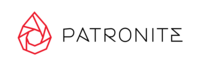

How to donate 1.5% to a Public Benefit Organization?

Here's how to fill out your PIT to donate 1.5% in tax to the Humanosh Foundation via your e-PIT or in a paper form.

Details:

- KRS number: 0000270261

- Specific Purpose: Humanosh20471

Your e-PIT

PIT - Paper form

How You Can Help

Support the work of our Foundation - only with your help can we succeed!

The founders of the foundation have been actively helping refugees for more than 15 years. Humanosh Foundation has been operating since 2020, with the help of the family, volunteers and thanks to the support of donors we help refugees and spread the story of the Wołosiański family.

Our mission is to build a reality in which every person feels safe and dignified, regardless of his or her background, race, religion or skin color.

Only with your help can we succeed!

](https://humanosh.org/wp-content/uploads/2023/01/SGH-photoutils.com2_.png)

](https://humanosh.org/wp-content/uploads/2023/01/CU-marketing-consulting-photoutils.com1_.png)

![ELEOS [photoutils.com].](https://humanosh.org/wp-content/uploads/2023/01/ELEOS-photoutils.com_.png)

![FOR_Logo_Horizontal [photoutils.com].](https://humanosh.org/wp-content/uploads/2023/01/FOR_Logo_Horizontal-photoutils.com_.png)

![Citizenship Fund [photoutils.com].](https://humanosh.org/wp-content/uploads/2023/01/Fundusz-obywatelski-photoutils.com_.jpg)

![GCF-logo-pdf-for-banners [photoutils.com].](https://humanosh.org/wp-content/uploads/2023/01/GCF-logo-pdf-for-banners-photoutils.com_.jpg)

![Ilios [photoutils.com].](https://humanosh.org/wp-content/uploads/2023/01/Ilios-photoutils.com_.png)

![Logo_National_Forum [photoutils.com].](https://humanosh.org/wp-content/uploads/2023/01/Logo_Krajowe_Forum-photoutils.com_.png)

![Neuca-1 [photoutils.com].](https://humanosh.org/wp-content/uploads/2023/01/Neuca-1-photoutils.com_.png)

](https://humanosh.org/wp-content/uploads/2023/01/ars_logo1-photoutils.com1_.jpg)

![Orlen [photoutils.com].](https://humanosh.org/wp-content/uploads/2023/01/Orlen-photoutils.com_.png)

![WUM-1 [photoutils.com].](https://humanosh.org/wp-content/uploads/2023/01/WUM-1-photoutils.com_.png)